|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

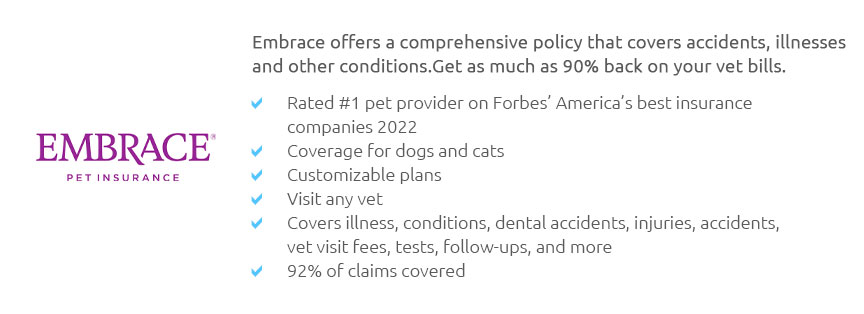

How to Choose the Right Pet InsuranceWhen it comes to safeguarding the health and wellbeing of your beloved pet, choosing the right insurance plan can be a daunting task. It's a decision that requires careful consideration and a deep understanding of your pet's needs as well as your financial situation. Here, we delve into frequently asked questions to guide you through this process. First, what is pet insurance? In essence, pet insurance is a policy that helps cover veterinary expenses when your pet falls ill or has an accident, potentially saving you from unexpected financial burdens. However, selecting the right plan isn't as simple as choosing the first option that appears in your search results. You must consider several factors. How do you determine the best plan for your pet? Begin by evaluating your pet's specific health requirements. Breed, age, and pre-existing conditions can significantly influence the type of coverage needed. For example, some breeds are predisposed to certain health issues, such as hip dysplasia in German Shepherds or heart problems in Cavalier King Charles Spaniels, which might necessitate comprehensive coverage. Additionally, consider the financial aspect of each plan. While a low monthly premium might seem attractive initially, it is crucial to examine the policy's deductible, co-pay, and coverage limits. You want to ensure that in the event of a significant health issue, your insurance will cover a substantial portion of the costs without leaving you with hefty bills. Furthermore, what does the policy cover? This is a pivotal question. Policies can vary widely, with some covering accidents only, while others include illnesses, hereditary conditions, and even routine care like vaccinations and annual check-ups. A comprehensive plan might offer more peace of mind, but it's important to weigh this against the cost. Also, are there any exclusions? Most policies have exclusions that could affect your coverage; common exclusions include pre-existing conditions or certain treatments like dental care. Reviewing these exclusions in detail can prevent unpleasant surprises down the road. Now, how does reimbursement work? Understanding the reimbursement process is essential. Some insurers offer direct payment to the vet, while others require you to pay upfront and get reimbursed later. The latter can strain your finances if you're not prepared. Equally important is the reputation of the insurer. Look for customer reviews and ratings, which provide insight into the company's reliability and customer service quality. A company with a reputation for denying claims or slow payouts may not be the best choice. Finally, don't forget to consider any additional benefits that the policy might offer, such as coverage for alternative therapies or boarding fees if you're hospitalized. These can add value to your plan. In conclusion, choosing the right pet insurance is a complex but crucial decision, demanding a balance between comprehensive coverage and affordability. By asking the right questions and thoroughly researching your options, you can find a plan that ensures your pet receives the best possible care without breaking the bank. Your furry friend is an integral part of your family, and having the right insurance can provide both peace of mind and financial security. https://www.ethosvet.com/blog-post/decisions-in-pet-insurance/

All pet insurance companies are not the same and coverage varies. The best advice I can give is that no matter what you end up choosing, read the legal ... https://www.rover.com/blog/5-tips-choosing-right-pet-insurance-dog/

We've put together this step-by-step guide to take you through the process of choosing pet insurance, with some tips to help you find the policy that works ... https://www.bankrate.com/insurance/pet-insurance/what-are-the-three-types-of-pet-insurance/

Choosing the right pet insurance policy can give pet owners the peace of mind and financial support for their pet's health needs. The three main ...

|